Despite a strong stock market, low unemployment, and relatively stable inflation, the U.S. economy may soon face a storm of uncertainty. Several approaching deadlines—ranging from tariff hikes to a potential debt ceiling crisis—are triggering concerns that the summer could bring significant economic disruption.

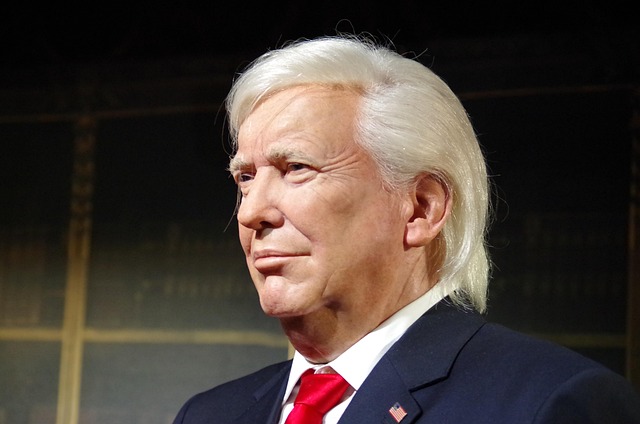

July 9 marks the expiration of a 90-day pause on reciprocal tariffs that President Donald Trump implemented to allow more time for bilateral trade deals. If nations fail to finalize agreements by then, they may be hit with substantial tariff increases. The administration has signaled that countries seen as “negotiating in good faith” may be granted leniency, but it’s unclear which nations qualify.

Adding to the pressure is an anticipated August deadline—described as the “X-date”—when the federal government could default on its debt obligations unless Congress raises the borrowing limit. Treasury Secretary Scott Bessent has called on lawmakers to act before the legislative recess begins on August 4. Though many experts believe a default is unlikely, the political brinkmanship alone could spook markets and consumers.

Trade Turbulence and Tariff Tensions Escalate

The Trump administration’s evolving trade policy continues to keep global markets on edge. After months of escalating tariffs, a brief reprieve was granted in April with the goal of brokering “bespoke” trade deals. However, only a few countries, including the U.K. and China, have finalized new agreements. Most of the 200 targeted countries are still in talks.

Current tariffs include 50% on steel and aluminum, 25% on automobiles, and a baseline 10% on goods from nearly all nations. The U.S. has threatened additional duties—up to 46% for Vietnam and 24% for Malaysia—if negotiations falter. Canada may soon face fresh penalties in retaliation for a new tax policy. Trump stated on Friday that if deals aren’t reached soon, countries will be notified of their new tariff obligations “to do business in the United States.”

Commerce Secretary Howard Lutnick noted that regional tariff strategies are under consideration, with ten trade agreements expected to be announced shortly. “We’ll categorize countries on July 9,” he told Bloomberg. This approach suggests that tariff rates may vary based on geography, economic behavior, or political relations.

Analysts warn that higher tariffs could drive up consumer prices. Economist Olu Sonola from Fitch Ratings predicts inflation may hit 4% by year-end if tariffs imposed on “Liberation Day” (April 2) return. The latest Consumer Price Index showed a 2.4% annual increase, but that could rise if trade tensions escalate.

Debt Drama Looms in Congress

Beyond trade policy, the debt ceiling looms as a significant challenge. Ryan Sweet, chief U.S. economist at Oxford Economics, believes Congress will act—albeit at the last moment—to avoid default. “It’s a bad movie we’ve seen before,” he said, though each passing week heightens concern.

As these events unfold simultaneously, the pressure on American households and businesses could increase. Spending is already slowing, and unemployment claims have risen to a four-year high. The coming weeks will test whether economic resilience holds—or cracks under the weight of compounding uncertainty.