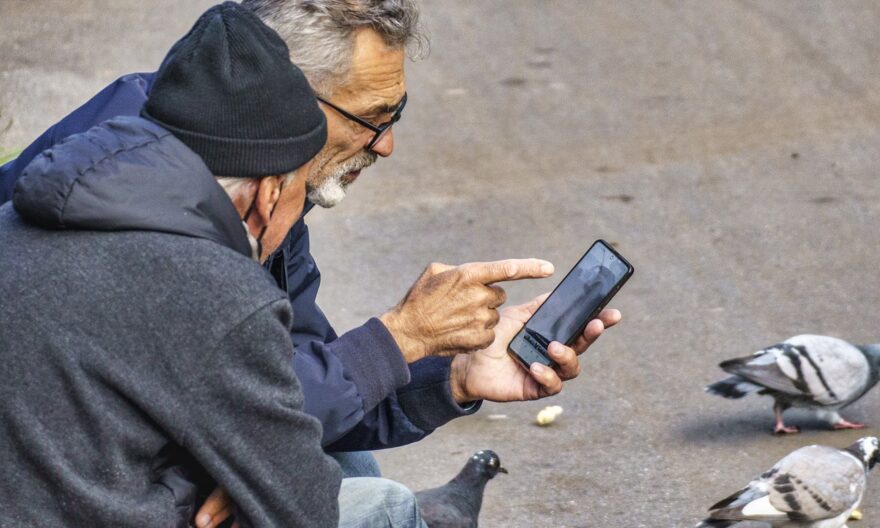

As technology advances and the methods of communication evolve, so do the tactics of scammers looking to exploit vulnerable groups. Among those most targeted are seniors, who often find themselves at the receiving end of various fraudulent schemes.

According to a report by the FTC, Americans aged 60 and older are particularly susceptible to scams, with approximately 1 in 5 seniors falling victim to financial exploitation. The report also found that this group suffered losses of $1.6 billion in 2022 due to scams.

So, here are some practical tips seniors can follow to protect themselves:

Stay informed

Awareness is the first line of defense against scams. Seniors should stay informed about the latest scams targeting their demographic. This includes understanding common tactics such as phishing emails, fake tech support calls, romance scams, and fraudulent investment schemes.

Government agencies like the FTC regularly publish alerts and resources specifically tailored to educate seniors about prevalent scams.

Verify requests for personal information

Scammers often pose as representatives from legitimate organizations, such as banks, government agencies, or tech companies, to trick seniors into divulging personal information.

Seniors should always verify the identity of the person contacting them and refrain from sharing sensitive data like Social Security numbers, bank account details, or passwords over the phone or email. Legitimate entities typically do not request such information unsolicited.

Be skeptical of unsolicited offers

Whether it’s an unexpected prize, a too-good-to-be-true investment opportunity, or a sudden emergency requiring immediate financial assistance, seniors should approach unsolicited offers with caution. Scammers often use high-pressure tactics to coerce victims into making impulsive decisions.

Seniors should take their time to research and consult with trusted family members or financial advisors before committing to any offers or transactions.

Secure personal devices

As more seniors embrace technology for communication and online activities, securing personal devices becomes paramount. Installing reputable antivirus software, enabling firewall protection, and regularly updating software and operating systems can help prevent malware infections and unauthorized access to sensitive information.

Seek assistance when in doubt

Seniors need to know that they are not alone in the fight against scams. If they encounter suspicious activity or feel unsure about a particular situation, they should reach out to family members, friends, or local authorities for guidance and support.

Additionally, organizations such as the AARP Fraud Watch Network provide resources and assistance to seniors dealing with scams.

By taking proactive steps to educate themselves and implement preventive measures, seniors can reduce their risk of falling victim to scams.